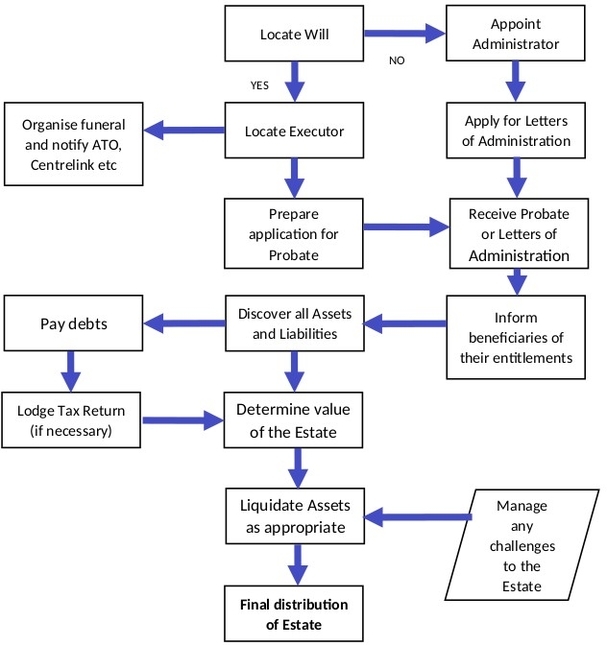

Decedent Estate Flow

The process of managing and distributing a deceased person’s estate, often referred to as the “Decedent Estate Flow,” involves several key steps and legal considerations. Here’s an overview:

1. Decedent and Legal Rights: A decedent can control where their assets go after they die via a will or trust. They have legal and financial obligations, including distributing their assets and paying outstanding taxes or debts, which they carry out through representatives such as an executor, administrator, or trustee.

2. Wills and Estate Laws in Canada: Inheritance laws, also called wills and estate laws in Canada, govern the distribution of a persons wealth when they die. These laws provide for minimum standards that wills should follow to be valid, court processes to be undertaken when the wills validity is being questioned, minimum requisites in appointing a valid executor of the deceaseds will, an administrator if theres no will, or a valid guardian for the deceaseds minor children.

3. Probate Process: Probate is a process that verifies the deceaseds last will and testament. If there wasnt a will, then the probate process confirms who the executor of the estate can be. The probate process helps to clarify these things as certain steps, forms, and notifications must be completed.

4. Estate Expenses During Probate: An executor is expected to pay the expenses of an estate on time, but what happens if the estate is tied up in the probate process? This includes taxes on income from registered retirement savings plans (RRSPs).

5. Period for Settling an Estate: For taxation and other legal purposes, the estate of a deceased person must be settled after the issuance of the Grant of Letters Probate and within the period stated in provincial wills and estate laws.

6. Deceased with a Will: In common law provinces, when a person dies with a will, what is stated in the will must be followed by the family. This may cover aspects like the distribution of wealth and the succession of properties, among others.

In conclusion, the Decedent Estate Flow is a complex process that involves various legal and financial considerations. It’s crucial to understand these aspects to ensure the smooth transition of the decedent’s assets and to fulfill their final wishes.